New Found Intercepts 152.1 g/t Au Over 3.85m & 12.98 g/t Au Over 14.95m at Lotto Main Vein, Confirms Continuity of High-Grade Over 220m Strike

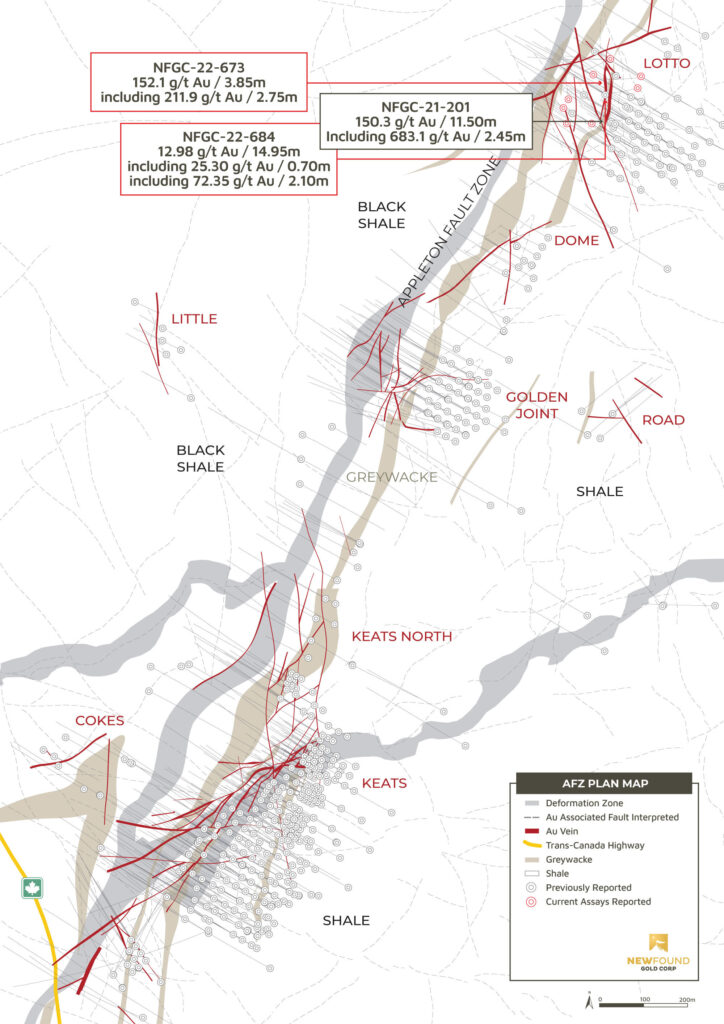

Vancouver, BC, September 13, 2022 – New Found Gold Corp. (“New Found” or the “Company”) (TSX-V: NFG, NYSE-A: NFGC) is pleased to announce the results from nine diamond drill holes that were completed as part of an infill and step-out drill program testing the Lotto Main Vein located 2km north of the Keats Zone along the highly prospective Appleton Fault Zone (“AFZ”). New Found’s 100% owned Queensway project comprises an approximately 1500km2 area, accessible via the Trans-Canada Highway approximately 15km west of Gander, Newfoundland and Labrador.

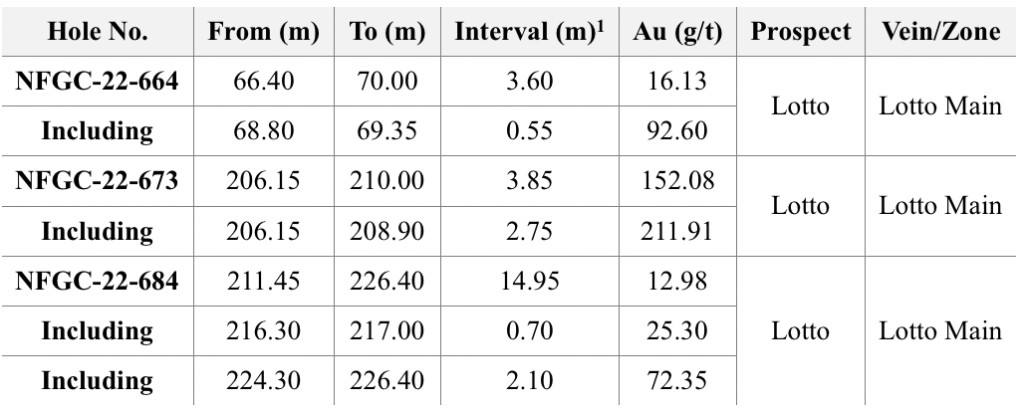

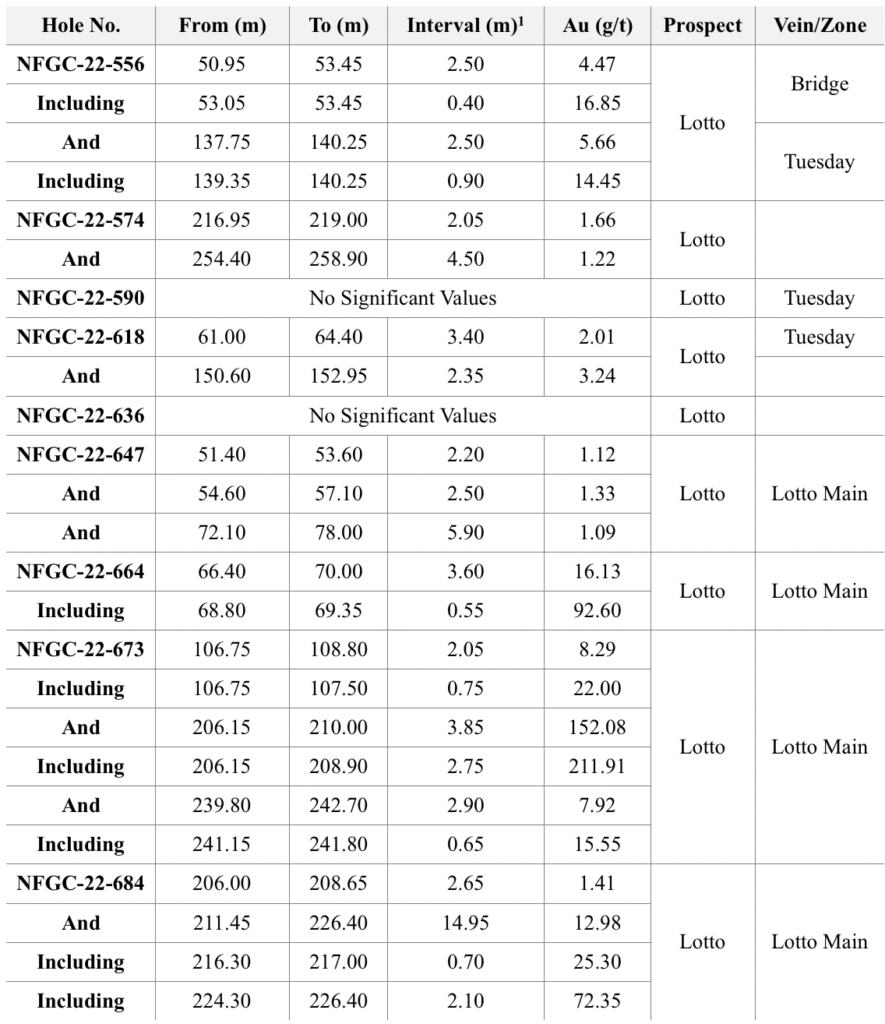

Lotto Highlights:

1Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 40% to 90% of reported intervals. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional uncertainty in true width. Composite intervals reported carry a minimum weighted average of 1 g/t Au diluted over a minimum core length of 2m with a maximum of 2m consecutive dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 10 g/t Au. Grades have not been capped in the averaging and intervals are reported as drill thickness.

- At the Lotto prospect, diamond drilling is progressing on a work program designed to step out and expand the known extents of the high-grade gold bearing Lotto Main Vein and to also infill in areas for better definition of the very high-grade gold domains which will help with understanding the mineralization controls and ultimately guide future exploration efforts.

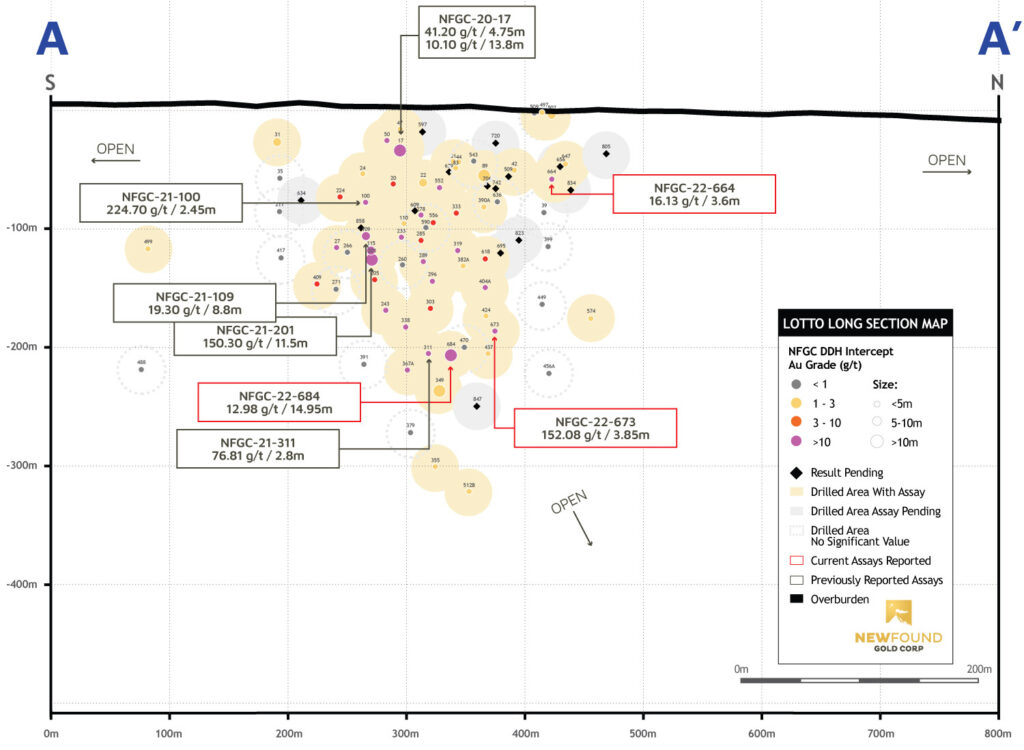

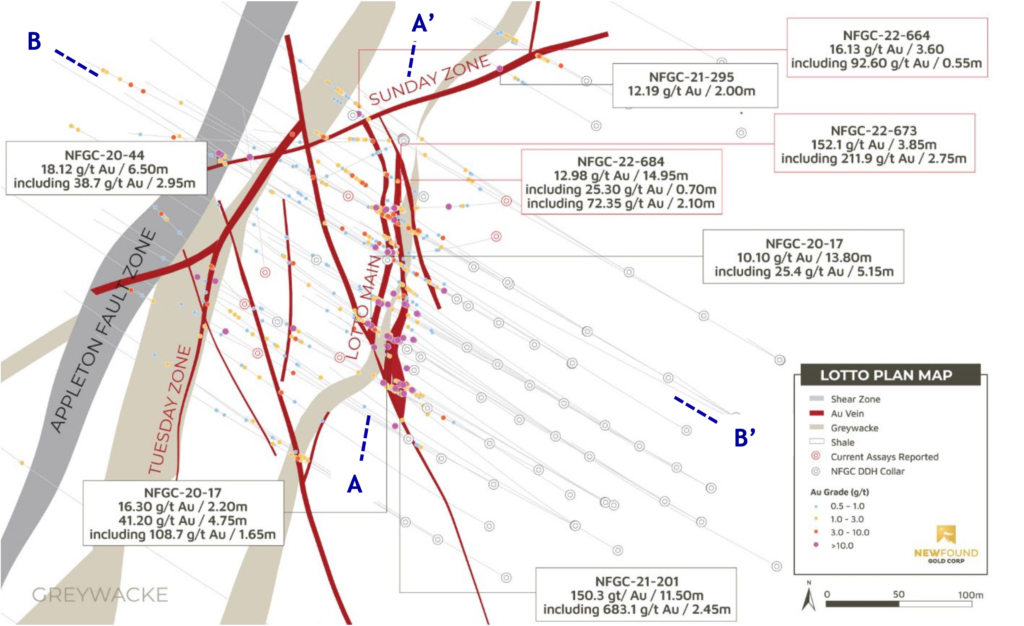

- The Lotto Main Vein contains high-grade gold mineralization that has now been defined over a strike length of 220m with the intercept of 16.13 g/t Au over 3.60m in NFGC-22-664 and to a depth of 225m. This intercept is 190m north of the previously reported 150.3 g/t over 11.5m in NFGC-21-201 (reported on June 23, 2021). The Lotto Main Vein target is not closed off in any direction along strike or to depth (Figures 1, 3, and 4).

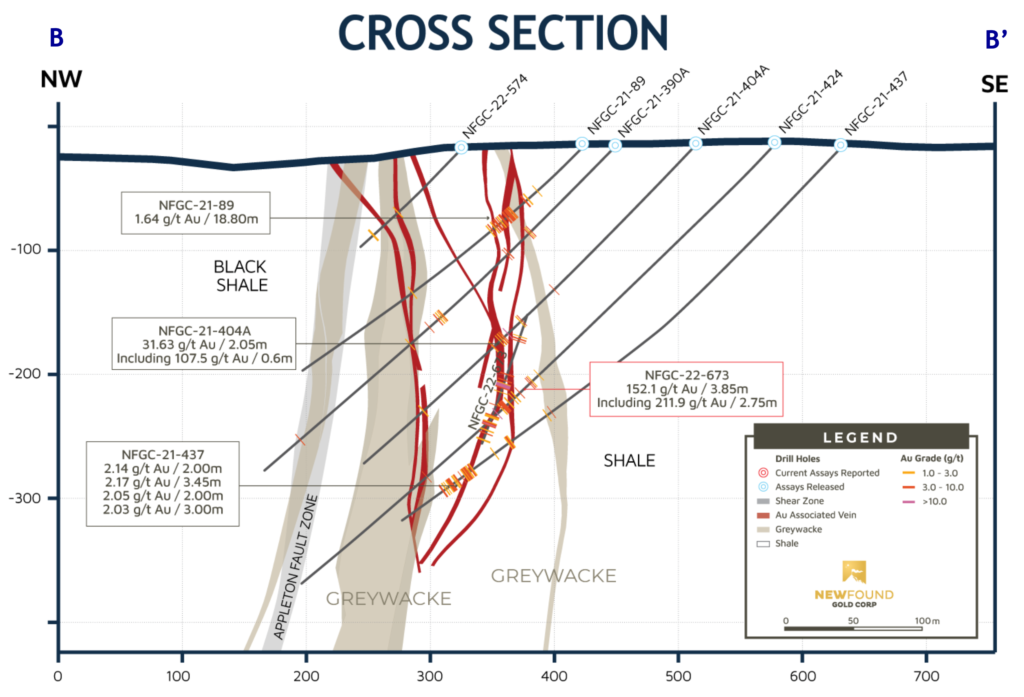

- Infill drilling at the Lotto Main Vein is targeting a “roll”, an area where there is a drastic change in the vein orientation, interpreted to be a location of dilation and potentially correlated to the emplacement of high-grade gold mineralization. The current drill results have provided further confirmation of this interpretation with the intercepts of 152.1 g/t Au over 3.85m in NFGC-22-673 and 12.98 g/t Au over 14.95m in NFGC-22-684 (Figures 1, 3, 4, and 5).

- This exploration work supports the current geological model and has also contributed to the understanding of the mineralization controls at Lotto. This improved understanding will allow for efficient testing of this high-grade corridor going forward as gold mineralization remains open in all directions.

Melissa Render, VP Exploration for New Found stated: “These results affirm the richness and potential of the Lotto Main Vein. After a short hiatus to focus on near-surface targets in this area, drilling has resumed testing this target area to depth, successfully expanding segments of the Lotto Main Vein that contain very high-grade gold. The Lotto Main Vein is open in all directions and ongoing exploration continues to capture critical information important to the understanding of the mineralization controls, namely that these sites of complexity are often the locations of high-grade gold mineralization thus representing high-priority target areas for future testing.”

^Note that these photos are not intended to be representative of gold mineralization in holes NFGC-22-664, NFGC-22-673, and NFGC-22-684.

Discussion

Mineralization at the Queensway Project is hosted by a fold-thrust sequence of northeast-striking, steeply dipping turbiditic sedimentary rocks deposited and deformed during the closure of the Iapetus Ocean and subsequent continent-continent collision. During this prolonged period of continued shortening, at least two regional-deformation zones developed and include the AFZ and JBP fault zones. The AFZ is interpreted to be a significant, deep-seated thrust fault that strikes southwest across the full 100km+ length of the property and is likely the main conduit for the gold mineralizing fluids, much like the Cadillac-Larder Lake Fault Zone in the Abitibi.

As a result of progressive deformation, the brittle host stratigraphy developed an extensive network of gold-bearing fault zones enveloping the AFZ, the extents of which are not yet known. Higher grades and widths of gold mineralization occur in areas where there was greater mineralizing fluid flow such as at structural intersections, at dilational openings within fault structures, and along lithological contacts where breakage occurs due to rheological differences in the compressional strength of contrasting sedimentary rock units. A significant amount of the high-grade gold mineralization is interpreted to be epizonal in nature, having been emplaced when tectonic movements resulted in the explosive tapping of deep gold-rich magmatic fluids that rapidly precipitated gold as they migrated towards surface.

A majority of the exploration drilling to date at Lotto has been focused on testing the Main Vein. Like the Golden Joint Main Vein, it too strikes north-south but is steeply dipping to the east. This specific vein also occurs approximately 200m east of the AFZ, has been defined to a vertical depth of 325m and over a length of 225m (Figures 1 and 4) and contains a high-grade segment now defined to a depth of 225m and over a strike length of 220m. The Lotto Main Vein is spatially associated with a brittle fault zone and is developed in close proximity to a narrow bed of greywacke. The Lotto Main Vein is often massive and vuggy with localized domains of brecciation. There is also an apparent high-grade domain that is interpreted to steeply plunge to the northeast. The vein at this location crosscuts the thin bed of greywacke, but also, the presence of late brecciated vein phases suggests that there is a fault intersection at this location. Continued exploration drilling in this area will focus on expanding the Lotto Main Vein high-grade domain but will also shift to systematic drill testing stepping north into untouched regions along the AFZ.

Drillhole Details

1Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 40% to 90% of reported intervals. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional uncertainty in true width. Composite intervals reported carry a minimum weighted average of 1 g/t Au diluted over a minimum core length of 2m with a maximum of 2m consecutive dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 10 g/t Au. Grades have not been capped in the averaging and intervals are reported as drill thickness.

Queensway 400,000m Drill Program Update

Approximately 63% of the planned 400,000m program at Queensway has been drilled to date with ~38,840m of the core still pending assay results. Fourteen (14) core rigs are currently operating meeting New Found’s targeted drill count for Q2.

Sampling, Sub-sampling, Laboratory and Discussion

True widths of the intercepts reported in this press release have yet to be determined but are estimated to be 40% to 90% of reported intervals. Infill veining in secondary structures with multiple orientations crosscutting the primary host structures are commonly observed in drill core which could result in additional variability in true width. Assays are uncut, and composite intervals are calculated using a minimum weighted average of 1 g/t Au diluted over a minimum core length of 2m with a maximum of 2m consecutive dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 10 g/t Au.

All drilling recovers HQ core. Drill core is split in half using a diamond saw or a hydraulic splitter for rare intersections with incompetent core.

A professional geologist examines the drill core and marks out the intervals to be sampled and the cutting line. Sample lengths are mostly 1.0 meter and adjusted to respect lithological and/or mineralogical contacts and isolate narrow (<1.0m) veins or other structures that may yield higher grades. Once all sample intervals have been chosen, photos of the wet and dry core are taken for future reference.

Technicians saw the core along the defined cut-line. One-half of the core is kept as a witness sample and the other half is submitted for crushing, pulverizing, and assaying. Individual sample bags are sealed and placed into shipping pails and/or nylon shipping bags, sealed and marked with the contents.

Drill core samples are shipped to ALS Canada Ltd. (“ALS”) for sample preparation in Sudbury, Ontario, Thunder Bay, Ontario, or Moncton, New Brunswick; an ISO-17025 accredited laboratory. ALS operates under a commercial contract with New Found.

The entire sample is crushed to approximately 70% passing 2 mm. A 3,000-g split is pulverized. “Routine” samples do not have visible gold (“VG”) identified and are not within a mineralized zone. Routine samples are assayed for gold by 30-g fire assay with an inductively-couple plasma spectrometry (“ICP”) finish. If the initial 30-g fire assay gold result is over 1 g/t, the remainder of the 3,000-g split is screened at 106 microns for screened metallics assay. For the screened metallics assay, the entire coarse fraction (sized greater than 106 microns) is fire assayed and two splits of the fine fraction (sized less than 106 microns) are fire assayed. The three assays are combined on a weight-averaged basis.

Samples that have VG identified or fall within a mineralized interval are automatically submitted for screened metallic assay for gold.

All sample pulps are also analyzed for a multi-element ICP package (ALS method code ICP61).

Drill program design, Quality Assurance/Quality Control, and interpretation of results are performed by qualified persons employing a rigorous Quality Assurance/Quality Control program consistent with industry best practices. Standards and blanks account for a minimum of 10% of the samples in addition to the laboratory’s internal quality assurance programs.

Quality Control data are evaluated on receipt from the laboratories for failures. Appropriate action is taken if assay results for standards and blanks fall outside allowed tolerances. All results stated have passed New Found’s quality control protocols.

New Found’s quality control program also includes submission of the second half of the core for approximately 5% of the drilled intervals. In addition, approximately 1% of sample pulps for mineralized samples are submitted for re-analysis to a second ISO-accredited laboratory for check assays.

The Company does not recognize any factors of drilling, sampling or recovery that could materially affect the accuracy or reliability of the assay data disclosed.

The assay data disclosed in this news release have been verified by the Company’s Qualified Person against the original assay certificates.

The Company notes that it has not completed any economic evaluations of its Queensway Project and that the Queensway Project does not have any resources or reserves.

Qualified Person

The scientific and technical information disclosed in this press release was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer, and a Qualified Person as defined under National Instrument 43-101. Mr. Matheson consents to the publication of this press release dated September 13, 2022, by New Found. Mr. Matheson certifies that this press release fairly and accurately represents the scientific and technical information that forms the basis for this press release.

About New Found Gold Corp.

New Found holds a 100% interest in the Queensway Project, located 15km west of Gander, Newfoundland and Labrador, and just 18km from Gander International Airport. The project is intersected by the Trans-Canada Highway and has logging roads crosscutting the project, high voltage electric power lines running through the project area, and easy access to a highly skilled workforce. The Company is currently undertaking a 400,000m drill program at Queensway, now approximately 63% complete. The Company is well funded for this program with cash and marketable securities of approximately $71 million as of September 2022.

Please see the Company’s website at www.newfoundgold.ca and the Company’s SEDAR profile at www.sedar.com.

Acknowledgements

New Found acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

Contact

To contact the Company, please visit the Company’s website, www.newfoundgold.ca and make your request through our investor inquiry form. Our management has a pledge to be in touch with any investor inquiries within 24 hours.

New Found Gold Corp.

Per: “Collin Kettell”

Collin Kettell, Chief Executive Officer

Email: ckettell@newfoundgold.ca

Phone: +1 (845) 535-1486

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement Cautions

This press release contains certain “forward-looking statements” within the meaning of Canadian securities legislation, relating to exploration, drilling and mineralization on the Company’s Queensway gold project in Newfoundland and Labrador; assay results; the interpretation of drilling and assay results, the results of the drilling program, mineralization and the discovery of zones of high-grade gold mineralization; plans for future exploration and drilling and the timing of same; the merits of the Queensway project;; future press releases by the Company; and funding of the drilling program. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “interpreted,” “intends,” “estimates,” “projects,” “aims,” “suggests,” “often,” “target,” “future,” “likely,” “pending,” “potential,” “goal,” “objective,” “prospective,” “possibly,” “preliminary”, and similar expressions, or that events or conditions “will,” “would,” “may,” “can,” “could” or “should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, risks associated with the interpretation of assay results and the drilling program, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company’s business and prospects. The reader is urged to refer to the Company’s Annual Information Form and Management’s discussion and Analysis, publicly available through the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.