Victory Metals & Nevada King Agree to Business Combination, Creating a Leading Nevada Gold Explorer and Developer

Victory Metals Announces Concurrent Minimum $8 Million Equity Financing Backstopped by Palisades Goldcorp Ltd.

Vancouver, British Columbia, November 20, 2020 – Victory Metals Inc. (TSX-V:VMX) (“Victory”) and Nevada King Mining Ltd. (“Nevada King”), a private B.C. company, announce that they have entered into a binding letter agreement (the “Agreement”) dated November 16, 2020, whereby Victory will acquire all the issued and outstanding shares of Nevada King (“Nevada King Shares”).

The business combination (the “Transaction”) will be completed pursuant to a statutory plan of arrangement whereby all of the outstanding Nevada King Shares will be exchanged for common shares of Victory (the “Victory Shares”). The shareholders of Nevada King will hold 50% of the issued and outstanding Victory Shares following completion of the Transaction (the “Exchange Ratio”).

Additionally, a key condition to the completion of the Transaction is to complete a minimum $8 million non-brokered private placement (the “Private Placement”). The Private Placement will be conducted on a post-Transaction basis and, as such, the common shares of the resulting issuer (the “Company”) to be issued to subscribers of the Private Placement will not be considered in the calculation of the Exchange Ratio. Victory and Nevada King are pleased to announce that Palisades Goldcorp Ltd. (“Palisades”), a major shareholder of both Nevada King and Victory, has committed to subscribe for any portion of the Private Placement that is not taken up by other investors.

Highlights of Transaction:

- The business combination will form a leading Nevada explorer and developer, focused exclusively on the Battle Mountain Trend, one of the world’s most endowed and prolific gold trends.

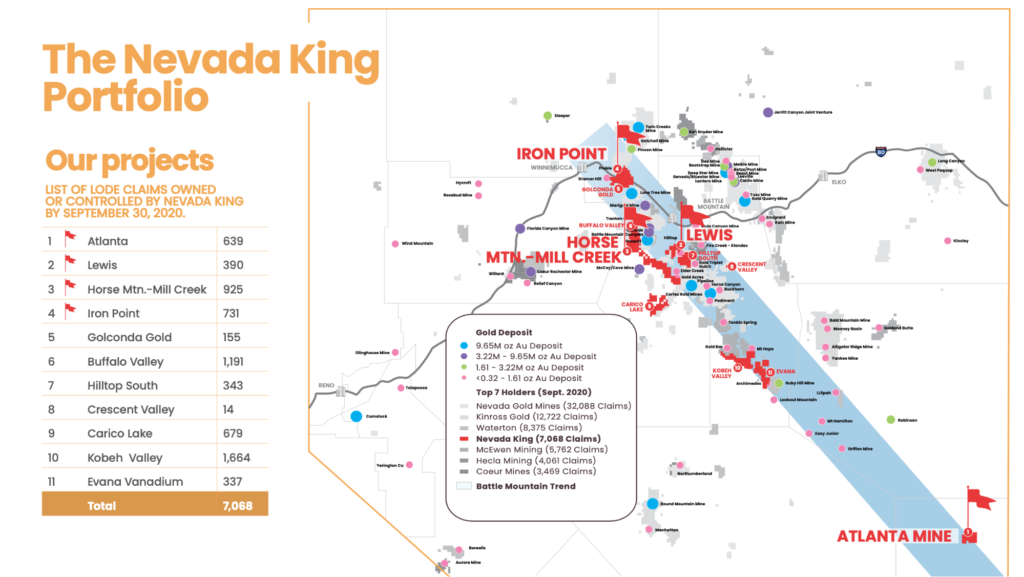

- Nevada King is the fastest growing mineral claim holder in the United States and now ranks as Nevada’s fourth largest active claim holder with 5,985 claims totaling 115,471 acres (467 km2), with an additional 1,082 claims currently in the process of being filed. Nevada King continues to pursue its program of strategic land acquisition on the Battle Mountain Trend.

- The transaction brings together two 100%-owned development stage assets:

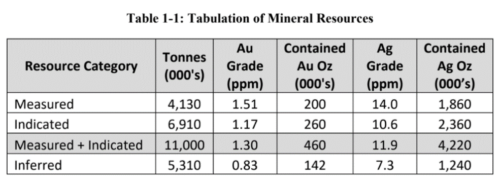

- Atlanta Gold Mine, Nevada – a past producing gold mine with recorded production of 110,000 ounces of gold and 800,000 ounces of silver (1975-1985). A recently completed National Instrument 43-101 (“NI 43-101”) compliant technical report dated October 29, 2020, by Gustavson Associates of Lakewood, Colorado, calculated a pit constrained, Measured and Indicated resource of 11 million tonnes grading 1.3 g/t Au and 11.9 g/t Ag using a 0.35 g/t Au only cut off, containing 460,000 oz Au and 4,220,000 oz Ag; and an Inferred mineral resource of 5.31 million tonnes grading 0.83 g/t Au and 7.3 g/t Ag, containing 142,000 oz Au and 1,240,000 oz Ag (see Table 1-1).

- Iron Point Vanadium/Gold Project, Nevada – North America’s largest mineralized vanadium footprint in a shallow, open-pittable configuration, currently moving towards a maiden NI 43-101 resource and Preliminary Economic Assessment, as well as a deep Carlin-style gold target currently being explored by joint venture partner Ethos Gold Corp.

- Atlanta Gold Mine, Nevada – a past producing gold mine with recorded production of 110,000 ounces of gold and 800,000 ounces of silver (1975-1985). A recently completed National Instrument 43-101 (“NI 43-101”) compliant technical report dated October 29, 2020, by Gustavson Associates of Lakewood, Colorado, calculated a pit constrained, Measured and Indicated resource of 11 million tonnes grading 1.3 g/t Au and 11.9 g/t Ag using a 0.35 g/t Au only cut off, containing 460,000 oz Au and 4,220,000 oz Ag; and an Inferred mineral resource of 5.31 million tonnes grading 0.83 g/t Au and 7.3 g/t Ag, containing 142,000 oz Au and 1,240,000 oz Ag (see Table 1-1).

- These core assets are combined with a portfolio of district-scale exploration projects in the heart of the Battle Mountain Trend including Golconda Gold, Horse Mountain-Mill Creek, Lewis, Hilltop South, Buffalo Valley, Cedars-Carico Lake, Kobeh Valley, and Evana (see Figure 1). These projects have seen significant historic exploration by numerous major mining companies and in many cases, are nearby or adjacent to large gold resources or operating mines.

- Importantly, advancement of this exploration and development portfolio will be managed by a highly experienced and successful team of mining entrepreneurs led by Executive Chairman Paul Matysek and Chief Executive Officer Collin Kettell. Mr. Matysek has sold his last five companies for a cumulative transaction value in excess of $2.6-billion. Mr. Kettell is the Founder and Executive Chairman of Palisades, a resource-focused merchant bank with $420-million of net assets and is Executive Chairman of New Found Gold Corp. with a current market capitalization of $600-million.

- Dr. Quinton Hennigh and Susan Lavertu will join the board of the Company. Dr. Hennigh is a world-renowned geologist and the Founder & Chairman of Novo Resources Corp., a TSX-V focused gold explorer and developer. Ms. Lavertu has held the position as CEO of Nevada King since its inception; she is a resource investor who acts as advisor to several publicly listed resource companies.

- Cal Herron, P.Geo., COO, will lead the Company’s technical team. Mr. Herron has over 40 years in the evaluation, design, and management of gold exploration projects, and has spent a significant portion of his career in Nevada. Dr. Quinton Hennigh and Doug Forster, P.Geo., bring significant geological and other expertise at the board level.

- Following the completion of the Private Placement, the Company will be well financed with a minimum of $11 million in working capital.

- On completion of the Transaction and the Private Placement, Management, Directors, and Insiders of the Company will own up to 57% of the issued and outstanding shares of the Company.

Paul Matysek, Executive Chairman of Victory, stated: “We are thrilled to transform Victory into a new Nevada-focused gold company with a diverse portfolio of development and exploration assets. Nevada King was an early mover and has been very successful in accumulating large strategic district scale gold projects in one of the best addresses globally for the discovery of large gold deposits. We are particularly impressed with their property acquisition strategy which is based on decades of on the ground experience and scientific rigor in understanding the controls of gold mineralization in the Battle Mountain Trend. The addition of Dr. Quinton Henning to the Board of the Company will be instrumental in guiding our exploration and development activities going forward. After the completion of the Transaction, our initial work will focus on 3 key areas: 1) further drilling at Altanta Mine to re-categorize resources and expand the existing gold resource: 2) at Iron Point, completing the maiden vanadium resource estimate while continuing to work with Ethos Gold to refine targeting for a deep Carlin-type deposit and 3) developing and prioritizing drilling on some of the most compelling target areas with significant gold mineralization historically identified on these project areas.”

Collin Kettell, Executive Chairman of Nevada King, stated: “We are very excited to be able to bring Nevada King’s project portfolio public through this transaction with Victory. Our team has spent five years staking and consolidating one of the largest land packages in Nevada’s Battle Mountain Trend, North America’s most endowed gold belt. We kicked off this strategy before the recent resurgence in interest in gold and were able to successfully acquire highly strategic project areas prior to the recent influx of competitors. We are particularly excited to have assembled an outstanding technical and corporate team for the advancement of this project portfolio that will now be led by Paul Matysek. With $11 million in working capital following the completion of the Transaction we will be well funded and are looking forward to kicking off multiple exploration and development initiatives.”

Atlanta Mine, Nevada

Nevada King owns 100% of the Atlanta Mine, located 100km southeast of Ely, Nevada, which is a historical gold-silver producer that currently hosts a NI 43-101 compliant mineral resource estimate constrained by a conceptual pit containing 11 million tonnes of measured and indicated resources grading 1.3g/t Au and containing 460,000 Au oz (Table 1-1). Inferred mineral resources are 5.31 million tonnes grading 0.83 g/t Au containing 142,000 Au oz. Past open pit production is reported to have been 110,000 oz Au and 800,000 oz. Ag (1975 – 1985). Exploration activities are currently covered by a BLM-approved Plan of Operations. Existing infrastructure includes electricity to the mine, phone/internet communications, access via a graded county road, and abundant water supply. The resource area remains open for expansion through further drilling.

- 2020 Updated Mineral Resource Estimate

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that the Mineral Resources will be converted to Mineral Reserves. The quantity and grade are estimates and are rounded to reflect the fact that it is an approximation. Quantities may not sum due to rounding.

Kevin Francis, SME RM, of Gustavson Associates is the Qualified Person with responsibility for the mineral resource estimate. Mineral Resources do not have modifying factors or dilution applied. Mineral Resources are presented at a 0.35 ppm gold only cutoff grade and constrained by a pit optimization shell developed at US $1500/ oz Au.

In the previous report, written in 2013, no economic pit analysis was applied to constrain the mineral resource estimate. Gustavson believes that this most recent presentation better represents a ‘reasonable prospects for economic extraction’. There is additional mineralized material indicated by the exploration and estimation process that exists outside the pit optimization shell. However, this material is not considered a Mineral Resource with current economic parameters in this report.

The 2021 exploration plan anticipates a US $2.5M expenditure designed to complete a Preliminary Economic Assessment (PEA) that includes metallurgical testing, 9000m of RC and core drilling, and an ambitious geophysical program. Most of the drilling is dedicated to expanding the existing Inferred mineralization eastward and northward of the pit constrained resource zone and at the same time converting Inferred to Measured-Indicated. The wide-ranging geophysical studies and soil sampling program seek to identify new gold targets elsewhere in the Atlanta District, which is in large part covered by alluvium and post-mineral volcanics.

Iron Point, Nevada

The Iron Point Project encompasses 12,822 acres and is located 22 miles east of Winnemucca, Nevada. The project area adjoins Interstate 80, is bisected by high voltage electric power lines, and is traversed by the Union Pacific railroad line across the northern property boundary. The primary gold target is Carlin-type gold mineralization hosted in Lower Plate carbonate stratigraphy below the Roberts Mountain thrust fault. Some of the world’s largest and highest-grade gold deposits are found in this Lower Plate Assemblage. The linear target zone coincides with a north-south striking range front fault that hosts strong Carlin-type gold pathfinder geochemistry along a 5km strike length. Based on previous drilling, significant gold mineralization in Upper Plate rocks typically starts at depths exceeding 100m. Ethos Gold’s 2019 drilling program penetrated the Roberts Mountain Thrust and encountered gold mineralization in Lower Plate carbonates in core hole VM-8C, bottoming at 710m depth in 5.8m grading 0.165ppm Au accompanied by elevated As, Sb, and Hg (true mineralized thickness unknown). On the heels of a district-scale geophysical program completed in late 2020, Ethos seeks to expand upon this deep gold intercept in its planned 2021 drilling program.

Board of Directors and Management:

Following completion of the Transaction, the Company’s board of directors will consist of Victory’s current board of directors (Paul Matysek (Executive Chairman), Collin Kettell, Douglas Forster, P.Geo. and Craig Roberts, P.Eng.) supplemented by Susan Lavertu, current CEO of Nevada King, and Dr. Quinton Hennigh, presently an advisor to Nevada King. Management of the Company will continue to be led by Victory’s current senior management team with the addition of Susan Lavertu as President of the Company.

Paul Matysek, M.Sc., Executive Chairman –

Mr. Matysek is a geologist/geochemist by training, a successful alpha entrepreneur and creator of shareholder value with over 40 years of experience in the mining industry. Since 2004 as either CEO or Executive Chairman, Mr. Matysek has sold five publicly listed exploration and development companies, in aggregate worth over $2 billion. Most recently, he was Executive Chairman of Lithium X Energy Corp., which was sold to Nextview New Energy Lion Hong Kong Limited for $265 million in cash. Mr. Matysek was President and CEO of Goldrock Mines Corp., which sold to Fortuna Silver Mines in July 2016. He was previously CEO of Lithium One, which merged with Galaxy Resources of Australia to create a multi-billion-dollar integrated lithium company. He served as CEO of Potash One, which was acquired by K+S Ag for $434-million cash in a friendly takeover in 2011. Mr. Matysek was also the co-founder and CEO of Energy Metals Corp., a uranium company that grew from a market capitalization of $10 million in 2004 to approximately $1.8 billion when sold in 2007.

Collin Kettell, Chief Executive Officer & Director –

Mr. Kettell is Founder & Executive Chairman of Palisades, Canada’s resource focused merchant bank, with current AUM of $420M. Collin comes from a family with deep ties to mining, including co-founding AuEx Ventures, the company responsible for discovering the Long Canyon deposit, a project ultimately acquired by Newmont for $2.3B. Mr. Kettell is also the Founder & Executive Chairman of New Found Gold Corp., which is currently exploring its flagship Queensway Project in Newfoundland; Co-Founder of Goldspot Discoveries (TSX-V:SPOT).

Susan Lavertu, President & Director –

Ms. Lavertu is the President & CEO of Nevada King since its inception, where she has been instrumental in organizing financing, advancing operations, and directing the overall strategy of the company. Ms. Lavertu is a private resource focused investor. She acts in the capacity as advisor to several TSX-V listed mining companies. Prior to working in the resource sector, Ms. Lavertu worked in marketing and online marketing in North America and Europe.

Bassam Moubarak, CPA, Chief Financial Officer –

Mr. Moubarak is a seasoned senior executive with over 10 years of experience in the mining industry. Most recently, Mr. Moubarak was chief financial officer of Lithium X Energy Corp., where he played a key role in its sale to NextView New Energy Lion Hong Kong Ltd. for $265-million. Prior to this, Mr. Moubarak was chief financial officer of Goldrock Mines Corp., where he played a key role in its sale to Fortuna Silver Mines Inc. for $180-million. He was chief financial officer of Petaquilla Minerals Ltd., where he was instrumental in raising in excess of $120-million to develop and bring into production the Molejon gold mine. He also played a key role in the sale of Petaquilla Copper Ltd. to Inmet Mining Corp. for $400-million and negotiated the sale of Golden Arrow Resources Corp.’s 1-per-cent net smelter return royalty on the Gualcamayo gold mine to Premier Royalty Inc. for $17.75-million. Mr. Moubarak is a chartered professional accountant and was previously a senior manager with the international accounting firm Deloitte LLP, where he led audits of public companies and oversaw SOX 404 implementations, with specific emphasis on the mining industry.

Cal Herron, P.Geo., Chief Operating Officer –

Mr. Herron acts as Chief Operating Officer for Nevada King since its inception. Mr. Herron is President of Quest Geological Consultants, a geo-consultancy group focused on minerals exploration in North America. Cal has over 40 years’ experience in the evaluation, design, and management of base and precious metals exploration projects in the United States and Asia. M.A. in Geology from California State University (1981); Professional Geoscientist (P. Geo.) registered in Ontario, Canada with APGO.

Doug Forster, M.Sc., P.Geo., Director –

Mr. Forster has been involved in the mining industry and capital markets for over 35 years having acted as geologist, company founder, director, senior executive, and financier. Mr. Forster was a founder, President and CEO of Newmarket Gold which was acquired by Kirkland Lake Gold in a $1 billion transaction in 2016. Doug has a proven track record in mergers and acquisitions, mine operations, resource project development and equity and debt financing. For over three decades Mr. Forster has been creating wealth for North American and International investors through natural resource discovery, exploration, and operations. Mr. Forster obtained his B.Sc. and M.Sc. in geological sciences from the University of British Columbia and he is a registered member of the Association of Professional Engineers and Geoscientists of British Columbia.

Craig Roberts, B.A.Sc., M.Phil., P.Eng., Director –

Mr. Roberts is a mining engineer with 35 years of operations, consulting, and investment banking experience. For the last 20 years Mr. Roberts has worked as a mining investment banker with First Marathon Securities, National Bank Financial, PI Financial, and Axemen Resource Capital, focused on institutional equity financing and merger and acquisition advisory mandates in the mining sector. Previous to this Mr. Roberts worked seven years with Wright Engineers/Fluor Corporation, focused on feasibility studies of various mining projects worldwide. Prior to this Mr. Roberts worked for five years in underground mining operations. Mr. Roberts holds a B.A.Sc. degree in Mining Engineering from UBC, an M.Phil. in Management Studies from Oxford University, and is registered as a Professional Engineer (Mining) in British Columbia. Mr. Roberts has taught mining engineering courses at UBC and is former Chair of the Mineral Economics Society of the Canadian Institute of Mining, Metallurgy, and Petroleum. He is currently CEO of New Found Gold Corp. and Ethos Gold Corp.

Dr. Quinton Hennigh, Director –

Dr. Hennigh is an economic geologist with 25 years of exploration experience, mainly gold related. Early in his career, he explored for major mining firms including Homestake Mining Company, Newcrest Mining Ltd and Newmont Mining Corporation. Dr. Hennigh joined the junior mining sector in 2007 and has been involved with a number of Canadian listed gold companies including Gold Canyon Resources where he led exploration at the Springpole alkaline gold project near Red Lake Ontario, a 5 million ounce gold asset that was recently sold. In 2010, Dr. Hennigh helped start Novo Resources and began assembling its Australian exploration portfolio. Dr. Hennigh obtained a Ph.D. in Geology/Geochemistry from the Colorado School of Mines.

Further Transaction Details:

The boards of directors of Victory and Nevada King have unanimously approved the Agreement and the terms of the Transaction. Given the related party nature of the transaction, certain directors of Victory and Nevada King abstained from voting on the Transaction. The parties intend to enter into a definitive arrangement agreement (the “Arrangement Agreement”) in the near future, which will set out the detailed terms of the Transaction.

The key conditions to the completion of the Transaction are approval of the plan of arrangement by the shareholders of Nevada King, approval of the issuance of the Victory Shares to the Nevada King shareholders and certain other matters by the shareholders of Victory, court approval, approval of the TSX Venture Exchange, completion of the Private Placement and other conditions customary for a transaction of this nature. No finder’s fee is payable in connection with the Transaction.

The transaction is a “business combination” subject to Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“ MI-61-101“). MI-61-101 provides that, in certain circumstances, where a “related party” (as defined in MI-61-101) of an issuer is acquiring the issuer, such transaction may be considered a “business combination” for the purposes of MI-61-101 and may be subject to minority shareholder approval, formal valuation and other requirements. Palisades is both a major shareholder of Victory and Nevada King, holding approximately 50% of the Victory Shares and 46% of the Nevada King Shares. Consequently, minority shareholder approval of the Victory shareholders will be required for the Transaction. It is expected that the Transaction will be exempt form the formal valuation requirement of MI-61-101 as Victory is not listed on a specified market set out in section 4.4(1)(a) of MI-61-101.

The Company will be seeking TSX Venture Exchange approval as soon as practicable and expects the transaction to be a “fundamental acquisition” and subject to TSX Venture Exchange policy 5.3.

Full details of the Transaction, including the Company’s assumption of any liabilities of Nevada King, will be included in the Arrangement Agreement and materials to be mailed to the shareholders of Victory and Nevada King for the shareholder meetings required in connection with the Transaction.

Fort Capital Partners acted as financial advisor to the Special Committee and board of directors of Victory and provided an oral report, subject to certain assumptions, that the Transaction is fair to the shareholders of Victory.

Further Private Placement Details

The Company intends to satisfy the Private Placement condition by raising a minimum of $8 million by way of non-brokered private placement financing priced at $0.55 per share of the Company. The Private Placement will be closed in conjunction with the completion of the Transaction with the investors funds being released to the Company at that time. Use of funds will include advancement of the Company’s development and exploration stage assets. Palisades, a resource focused merchant bank, has committed to subscribe for any portion of the Private Placement that is not taken up by other investors.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by NI 43-101.

The technical information surrounding the recently released NI 43-101 compliant mineral resource for the Atlanta Mine has been reviewed and approved by Kevin Francis, SME RM, who is a Qualified Person as defined by NI 43-101.

About Victory

Victory owns a 100% interest in the Iron Point Vanadium Project, located 22 miles east of Winnemucca, Nevada. The project is located within a few miles of Interstate 80, has high voltage electric power lines running through the project area and a railroad line passing across the northern property boundary. The Company is well financed to advance the project through resource estimation and initial feasibility study work. Victory has a proven capital markets and mining team led by Executive Chairman Paul Matysek. Major shareholders include Palisades ([50]%), and management, directors and founders (27%). Approximately 28% of the Company’s issued and outstanding shares are subject to an escrow release over the next two years.

Please see the Company’s website at www.victorymetals.ca.

For more information, contact Collin Kettell at ck@victorymetals.ca or (301) 744-8744.

About Nevada King

Nevada King is the fourth largest mineral claim holder in the State of Nevada, and the fastest growing mineral claim holder in the United States. Nevada King owns 100% of the Atlanta Mine, located 100km southeast of Ely, Nevada, which is a historical gold-silver producer that currently hosts a NI43-101 compliant mineral resource estimate constrained by a conceptual pit containing 11 million tonnes of measured and indicated resources grading 1.3g/t Au and containing 460,000 Au oz (Table 1-1). Inferred mineral resources are 5.31 million tonnes grading 0.83 g/t Au containing 142,000 Au oz. Past open pit production is reported to have been 110,000 oz Au and 800,000 oz. Ag (1975 – 1985). Exploration activities are currently covered by a BLM-approved Plan of Operations. Existing infrastructure includes electricity to the mine, phone/internet communications, access via a graded county road, and abundant water supply. The resource area remains open for expansion through further drilling.

Please see the Company’s website at www.nevadaking.ca

For more information, contact Susan Lavertu at susan@nevadaking.ca or (615) 516-2572.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of the Company, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or” should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, statements relating the terms of the Transaction; the terms of the Private Placement, managements expectations regarding the Transaction, the terms of the Arrangement Agreement, the Company’s future outlook and anticipated events or results; and the completion of the Transaction. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Victory, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the Victory’s failure to complete the Transaction, the failure or Victory shareholders or Nevada King shareholders to approve the transaction, the failure of the TSX Venture Exchange to approve the Transaction and the Private Placement and management’s discretion to reallocate the use of proceeds. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Victory does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.