Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

All Roads Lead to Gold in 2020

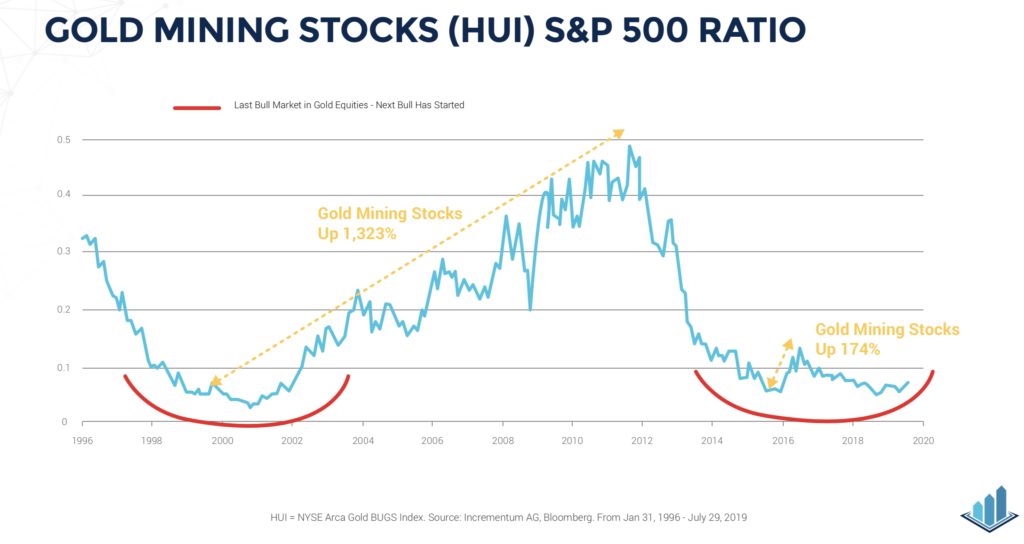

After spending the past eight years in a painful bottoming process, gold stocks are set for an epic run in 2020.

Aside from a short-lived move in 2016, gold mining equities have been taken to the woodshed. Their share prices have been butchered, and rubbing further salt in the wounds of gold investors, the prices of global equities, bonds, and real estate have all skyrocketed over the same timeframe.

Throughout this prolonged malaise of the 2010s, I have maintained a positive long-term outlook for the mining sector. Protracted bear markets, while quite painful, provide savvy individuals with the opportunity to buy assets and equities at deeply discounted valuations. Of course, figuring out that a sector is depressed is the easy part; what is quite difficult to ascertain is when a sector is poised for an imminent turnaround or breakout.

Gold prices have steadily risen since 2016, with the price of the metal carving out successive higher bottoms. Nevertheless, the macro picture during the past three years had not been signaling that a large breakout in gold was imminent… until the last six months that is!

For those paying close attention, the last six months have been truly exciting. I believe the writing is on the wall for a massive gold rally over the next few years.

One highly noteworthy development that I have observed is that receptiveness to gold has improved markedly over the past year. Gold is no longer being mocked on a routine basis as a “barbarous relic” and unworthy of a serious investor’s attention.

I got the inspiration for this article after watching an interview with Dr. Thomas Kaplan. Dr. Kaplan is a billionaire investor who focuses principally on the metals and mining space. He is the Chairman of Electrum Group, a private equity firm based in New York; he is also the Chairman of NovaGold, a company that owns a 50% stake in the world’s largest primary gold deposit.

In a fantastic interview with RealVision, Dr. Kaplan made several important points in explaining his bullishness on gold. Dr. Kaplan pointed out that a year or two ago, if a fund manager talked about gold on CNBC, that fund manager would be ridiculed by fellow guests and the resident pundits. Today, that same conversation goes quite a bit differently.

What prompted this change? Dr. Kaplan’s explanation is that a number of serious names have publicly come out in favor of gold – individuals who collectively cannot be dismissed as cranks or gold bugs. Interestingly, these high-powered individuals are coming to gold from very different perspectives and backgrounds.

1. Ray Dalio – The Hedge Fund Guy (Forbes Net Worth: $18.7B)

The founder of one of the largest hedge funds in the world, Bridgewater Associates, Dalio was among the first mainstream investors to publicly make the case for gold. In July 2019, Dalio posted a long blog entry focused on “paradigm shifts” in investing. He posited that ultra-low interest rates, unfunded social liabilities, and massive government deficits have created an environment ripe for monetary devaluation. Within this emerging paradigm, Dalio predicted gold would be a top-performing asset.

2. Paul Tudor Jones – The Macro Trader (Forbes Net Worth: $5.1B)

Jones, another major player in the hedge fund world, is a renowned macro-focused trader. Known for his bets on interest rates and currencies, Jones made over $100M shorting the markets on Black Monday in October 1987. In June, during an interview with Bloomberg Markets, he said, “I think one of the best trades is gonna be gold. If I had to pick my favorite bet for the next 12 to 24 months, it’d probably be gold.”

3. Jeff Gundlach – The Bond King (Forbes Net Worth: $2.1B)

Gundlach, founder and CEO of DoubleLine Capital, is an expert in bonds and other debt related instruments. In 2011, he appeared on the cover of Barron’s as “The New Bond King.” Gundlach, who correctly predicted the subprime loan crisis prior to the 2008 crash, has recently been sounding the alarm about unsustainable corporate and government debt loads in the U.S. economy. During a webcast in June 2019, Gundlach said, “I am certainly long gold”; in a subsequent interview, he predicted that the price of gold would rise to $1600-$1700.

4. Mark Mobius – Emerging Market Guru (Forbes Net Worth: N/A)

Mobius, the executive chairman of the Templeton Emerging Markets Group, is one of the foremost experts in the world on emerging markets. Under his watch, an investment of $100,000 in the Templeton Emerging Markets Fund 30 years would be worth nearly $3.5M today. In a July interview, Mobius stated, “gold’s long term prospect is up, up and up,” citing high demand for the metal in Asia and low interest rates globally. He advocates for investors to hold 10% of their portfolios in physical gold.

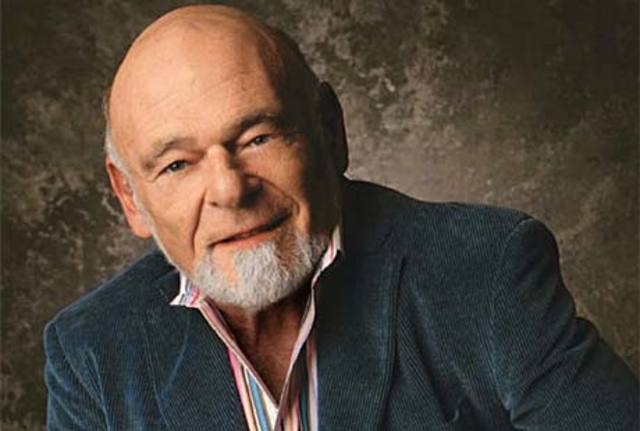

5. Sam Zell – Real Estate Maven (Forbes Net Worth: $5.6B)

Zell is often referred to as the founding father of the modern real estate industry. As part of his empire, he founded and chaired Equity Residential, the largest apartment owner in the nation, and Equity Office Properties Trust, formerly the largest owner of office space in the U.S. Last year, Zell bought gold for the first time in his life, calling it a “good hedge.” His thesis is that the amount of capital being invested into new gold mines is practically non-existent, meaning, “supply is shrinking and that is going to have a positive impact on the price.”

In the past, associating oneself with gold would immediately earn a person the derisive label of a gold bug. The environment has now shifted sufficiently, however, to allow people to come out and vocalize their support for gold.

It is extremely interesting to note that the five billionaires listed above all come from different backgrounds in the markets. You have the Bond King, an emerging markets guru, one of the world’s largest hedge fund managers, a fixed-income manager, and a major real estate investor. This represents a basket of investors with different areas of expertise – equities, bonds, and real estate – who all have reached the same conclusion to buy gold.

In the interview mentioned above, Dr. Kaplan opines that a 1% allocation to gold by generalist investors would probably equate to a doubling in the price of gold. That major market players, including the 5 men listed above, are expressing such positive sentiments about gold makes it more likely that the gold price will eventually reach the $3000 level that Dr. Kaplan is forecasting. This gold market could gain traction vey quickly and could surprise even the most ardent gold bugs in terms of its upside. Jump on the train before you miss it!

Until next week,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.