Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

Selling something at a high price – that is how you make money

Dr. Thomas Kaplan is recognized for a few notable items. For one, he is the largest private collector of Rembrandt. He is also the world’s best known big cat conservationist via his non-profit Panthera. And fueling these hobbies and initiatives, Dr. Kaplan is a highly successful resource investor, which has propelled him into the ranks of billionaire status.

Dr. Kaplan’s website states his business thesis as follows: “the enthusiastic and determined pursuit of extraordinary assets to express his conviction about a specific, often out-of-favor commodity.”

In that vein, several years ago, Dr. Kaplan made an important statement that has stuck with me to this day, and in fact, we have it prominently quoted on our website – “People think production is how you make money, it is not, it is selling something at a high price, that is how you make money.”

Implied but not expressly stated in this bit of wisdom is an important point – that in order to sell something at an elevated price and book a handsome profit, one must act with foresight and buy inexpensively when others are not so keen.

The founding of New Found Gold…

Back in 2015, Denis Laviolette and I formed a company under the moniker Palisade Resources. Palisade Resources ultimately changed its name to New Found Gold Corp (TSX-V:NFG), and in the process spun out GoldSpot Discoveries (TSX-V:SPOT), as well as Casino Gold and Victory Metals (TSX-V:VMX), which recently merged to form Nevada King (TSX-V:NKG).

At the inception of Palisade Resources, Denis and I shared similar vision – acquire assets cheaply in a market with next-to-no competition. That was the landscape we faced in 2015 as gold scraped along a bottom at $1,080 per ounce.

My background in resources was heavily influenced by watching my Dad make a splash in Nevada, founding AuEx Ventures, a company that discovered Long Canyon and eventually sold to Newmont for $2.3-billion. With that in mind, I was fixated on elephant hunting in the Great Basin.

Denis’ background as a geologist working in major northern camps like Red Lake, Timmins, and Kirkland Lake instilled a partialness to Canadian geology.

This dichotomy of backdrops led to a land bank with two very different addresses. Denis wanted to focus on Canada; I preferred to focus on Nevada.

Thank goodness for Denis’ insistence on Canada, because it brought us to Newfoundland for our very first site visit panning for gold atop the Keats Zone at what is now Queensway.

Back in Toronto and shortly after our first trip to Newfoundland, Denis crossed paths with a relatively unknown Reno-based geologist by the name of Cal Herron. Cal had just returned from a fifteen-year stint in China, working as a geologist for several state-owned mining ventures. His background and passion, however, lay in the Great Basin.

Denis thought it prudent that I meet Cal and so I flew to Reno that month and met with Cal at the Peppermill Resort & Casino, with an all you can eat buffet of sushi – yuck. Fortunately, the meeting was more agreeable than the meal and there began our Nevada land staking program.

Cal was different than most geologist I had met. Instead of fixating on specific targets and theories, Cal saw a massive opportunity by focusing on the bigger picture…

The bear market had laid ruin to a sea of junior companies, and even the majors – namely Barrick and Newmont. The two behemoths were dropping prime ground in the Battle Mountain Trend for the first time in decades. The Battle Mountain Trend is the best endowed gold trend in North America.

With a focus on production, Barrick and Newmont spared operating mines and resources, but dropped many of their very best exploration targets.

Cal and I both recognized this spelled opportunity and we made a pact – I would find the money; Cal would get the ground.

Cal with a crew of claim-stakers tirelessly swept in and sucked up ground at furious pace.

In retrospect, it is incredible to step back and think for a moment about the truly unique state of 2015. Barrick & Newmont, two multi-billion-dollar bellwethers of the gold mining industry, had gotten themselves into such states of disrepair, that they were cutting everything and anything to stay alive. Exploration teams went out the window. Management cuts were far reaching. Mines were sold off. And some of their prime exploration ground was dropped.

The combined cost for these two companies to hold all of their claims in Nevada – the world’s best gold mining jurisdiction – is less than $10-million per year. In a decision they likely now regret, to save a couple of million dollars, they opened up the door for a company like Nevada King to come in and create a formidable ground package.

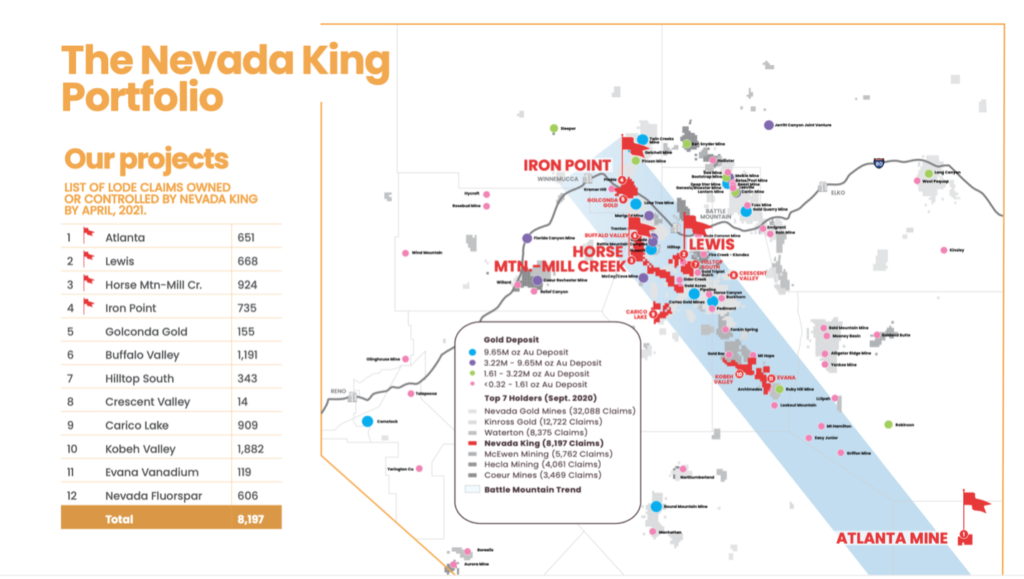

By 2019, Cal had staked over eight-thousand claims – the old-fashioned way – with stakes and hammers. That is 40,000 stakes that were pounded into the ground and filed with the Bureau of Land Management. Some of this staking took place in flat open Nevada desert, but many involved billy goating up the sides of mountains to locate.

The Nevada landscape began to shift…

It is at about that time that the landscape for Nevada exploration began to shift. The junior market saw its first notable lift in 2020 and several junior outfits sprouted up, interested in getting a piece of the Battle Mountain Trend.

The opportunity to acquire tier 1 exploration targets is perfectly clear in hindsight. Unfortunately, for those now aware that a gold market is brewing, the opportunity to make meaningful acquisitions via staking has passed.

Dr. Kaplan’s above stated business thesis to pursue great assets in out-of-favor commodities is not a new invention. In fact, Rick Rule, Ross Beatty, and many of the others greats of our times have also employed this exact same philosophy.

In any case, it perfectly encapsulates Nevada King’s genesis, which leads me to an important point… The seeds of success for the bull market we are now in were planted over the past few years in less favorable of times. Yet, companies that did not take the time to germinate those ideas will begin to sprout like weeds with little thought and foresight, instead led by the human desire for instant gratification.

In July 2020, I penned an article titled The Easiest Money You Will Ever Make in your Life is During the First 12 Months of a Junior Bull. As the name suggests, investors early enough to a bull market face far less risk and as such can less discriminately deploy capital. This is why Palisades Goldcorp was the most active industry financier last year, with our team focusing on great terms and long dated warrants over other metrics – things were just so stinking cheap.

But now, the landscape is changing. Good deals and bad deals are rising in market cap, and being selective is getting far more important.

Investors need to pay attention to which companies have the teams and assets that were built with thoughtful consideration and at the right time. Those are the opportunities that will make investors wealthy as they represent the best chances for a change of control premium.

Nevada King stands alone…

Nevada King stands alone as a junior company that ranks in a field of major landholders in the most prolific gold mining state.

In the past six months since announcing Nevada King’s intention to go public, four majors have either entered or re-entered Nevada with commitments ranging from $10-million all the way up to $500-million. They include –

- Newcrest

- First Majestic

- Equinox

- Hoschchild

- And the list is growing…

Nevada King is the fourth largest landholder in Nevada behind three of the world’s largest public gold producers –

- Newmont

- Barrick

- Kinross

- Nevada King

Major miners are hunting for a spot at the table and as money trickles down even more to exploration, Nevada King is a prime take-over candidate. As the likes of Newcrest and First Majestic play offense, and Newmont and Barrick play defense, Nevada King exists in neutral territory waiting for a captor willing to pay the highest price.

This year, our team turns its attention to unlocking as much value from that ground as possible by drilling a minimum of four projects – Iron Point, Horse Mountain-Mill Creek, Lewis, and Atlanta. The possibility of a discovery or fresh target vectoring is extremely valuable. But as Dr. Tom Kaplan presciently points out, it is selling something at a high price, that is how you make money!

Until next time,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.