Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

Junior Miners are Ready for Imminent and Explosive Lift Off

With 75% of public resource companies listed in Canada, the Toronto Venture Exchange (TSX-V) has become the de facto proxy for the junior resource market. On Friday, February 28th, the TSX-V hit its lowest point since inception, registering at 479, roughly matching the lows witnessed in late 2015.

This is shocking for a couple of reasons. 1) The last time the TSX-V reached these levels, gold was $620 cheaper than it is today! 2) Major gold mining companies are 125% above their lows reached in 2015, yet the junior sector is at its lowest.

It is a well-known fact among industry veterans that a prominent trickle-down effect takes place in every mining cycle. Money which initially pours into gold, quickly moves into major mining equities, as a result of their increased profit margins. Next, the lesser known mid-tier companies gain traction as investors seek to position capital for bigger gains. And finally, the juniors – a segment of the market with no cash flow and driven by pure speculation – get a bid. Fireworks erupt and fortunes are made.

Eyeing Billionaire Eric Sprott’s execution over the past few years provides a textbook scenario of how to take advantage of this phenomena. As the largest shareholder of Kirkland Lake Gold (KL.TO), Eric experienced tremendous gains as the company elevated itself to a major producer. In early 2019, Eric began liquidating a significant portion of his billion-dollar position in Kirkland in search of superior gains to be had in the smaller producers. Before long, he began to deploy into select juniors that he believed were poised to gain market traction first. Just recently, Eric has descended into the lowest rung of the sector – writing $1M checks and smaller into a wide array of small junior companies. Eric understands the psychology of the resource space intimately and nobody is better positioned to capitalize off of the upcoming boom.

Yet, despite Eric and a few investors who are enthusiastic about the space, the lion share of resource investors are avoiding the juniors like the plague. The trickle-down effect this time around is protracted. Blinded by recent experience and the sector’s dismal performance, there exists a widely held mantra within the industry that things are going to be different this time.

Many investors believe that money which in the past has poured into the juniors will fail to materialize. I’ve heard suggestions that money is smarter and more selective this time, or that money will only rush to the big names due to the advent of passive funds. I could not disagree more strongly with this belief.

Look no further than the irrationality displayed during the cannabis bubble to see the willingness of investors to indiscriminately shotgun money into the ether with no sector knowledge, whatsoever.

The juniors have become so discounted compared to the majors, and in light of rising gold prices, that it is only a matter of time until money rushes into the sector. And once gains begin to stack up, those on the sidelines will rush toward the action.

As shocking as it is that money has so far failed to reach the junior space, for a resource investor, this is the opportunity of a lifetime. Savvy investors can finance juniors at lows not seen since 2015, despite the fact that gold is in a full-blown bull market!

I am not suggesting a strategy to indiscriminately deploy capital. In fact, an opportunity exists right now to focus on the cream of the crop, and structure deals that take advantage of deep discounts. But it is important to recognize that when juniors do take off, understanding the psychology of the junior space will win the day. There is a lot more that goes into capturing the biggest gains then identifying the best assets and the best teams.

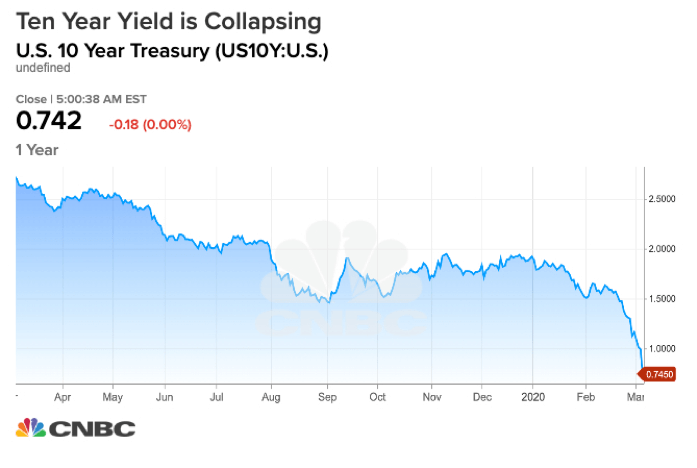

It is also important to recognize the potential for a global market meltdown already in action. I was shocked this morning to see the speed at which the yield is collapsing.

The US Equities have already witnessed a 12% correction and I suspect we are going to see something far worse coming down the pike. This has the obvious risk of dragging down all equities including juniors. But, at the same time, a negative real rate environment is the perfect storm for a prolonged and powerful gold bull run. The fundamentals are all in place and we now stand on the precipice of what’s to come.

I am confident that investing in a basket of junior resource stocks through the use of private placements will generate unbeatable returns in the months and years ahead. This is why I founded Palisades Goldcorp in August of 2019 – as an investment vehicle that can take advantage of a sector that I believe will be the clear winner. The train is about to leave the station on an investment opportunity we will not see again for a long time to come.

Until next week,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.