Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

Gold Has a Long, Long Way to Go

The Toronto Venture Exchange is a well-known proxy for the junior resource sector. The index has been in a decade’s long lull, which was further exacerbated by the precipitous decline in March of this year. I touched on this two weeks ago in an article titled The Bigger the Base, the Bigger the Bull.

Get this… Since its peak in 2007, the Venture is down over 90%!

With 55% of the Venture comprised of resource related equities, that means the junior sector (responsible for that drop) is off more like 95%!

Find me another exchange that has performed as poorly since the ‘08 crash. You won’t. In fact, almost every index out there is up considerably over that time frame. Even the Australian Stock Exchange, which is heavily weighted towards mining, is up since 2008.

But like they say, what goes up must come down. And less supported by the laws of physics… what comes down, must go up.

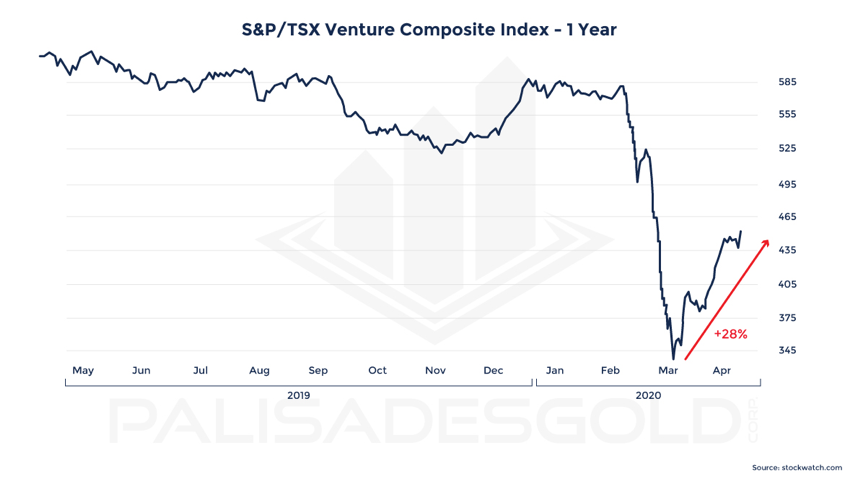

For those closely monitoring the juniors, the past couple weeks certainly feel like the onset of that inevitable move higher. Take a look at the below chart, which shows a one-year performance of the Venture Exchange.

Note – that “feeling of a bull market” emerging has occurred over a very short time frame.

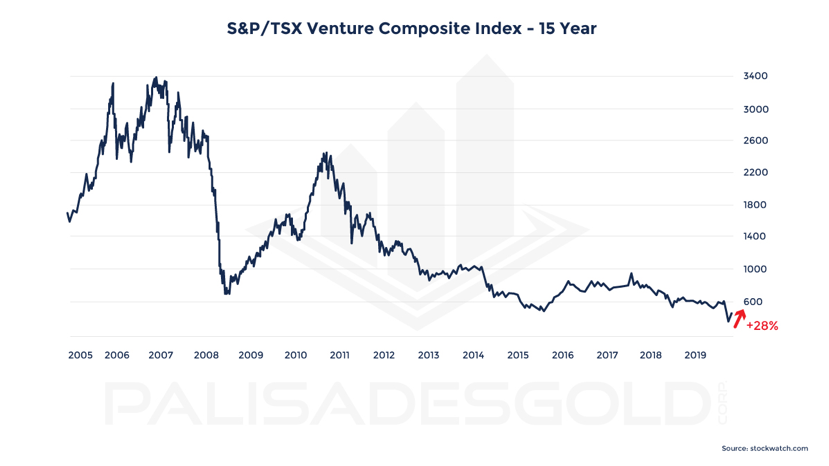

Now lets zoom out to a fifteen-year view of the index, and take a snapshot of what that “feeling of a bull market” move looks like in context of the preceding decline.

The move hardly registers in context of the big picture.

Emerging from a decade long decline is rather unusual and should bode well for investors as we enter a bull market.

It is intuitive that bear markets are shorter than ensuing bull markets. After all, what takes years to build can be torn down in days or weeks. The ‘08 crash and the crash of 2020 are perfect examples.

In fact, of the 3 major mining bear markets in the past thirty years, the bull markets that followed were longer in every case.

It is critical to recognize that today’s sprouting of a bull market will likely last for the better part of this decade. Gold stocks have witnessed a painful and prolonged decline. But, for those who have weathered the bear market with capital to spare, there likely exists a long, long way up for gold.

Until next week,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.