Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

The Power of the Almighty Warrant – In Action

How lucrative are junior mining private placements? Any serious investor in the junior resource space will likely tell you that you are making a mistake investing any other way. And that is because of the value of a warrant.

I have been extolling the virtues of the almighty warrant for the past few years. The junior mining warrant is one of the most valuable but under-recognized financial instrument available to investors in the public markets.

From 2001-2007, I witnessed as my Father turned a quarter million-dollar mortgage on our family house into tens of millions of dollars of wealth. An integral part of his investment strategy was the use of warrants.

In 2003, I met Phil O’Neill who is now Chief Operating Officer of Palisades Goldcorp. At that time, Phil took out a $20,000 loan on his MasterCard and parlayed it into millions by investing in private placements.

These are not isolated circumstances either. I can list off ten people I know who all managed to make 100X on their junior resource portfolio during the last cycle. The one thing they all did in common is participate in private placements.

So what is a warrant and why is it so important? Well let’s take a real-life look at how Palisades Goldcorp just as recently as last month structured financings with warrants.

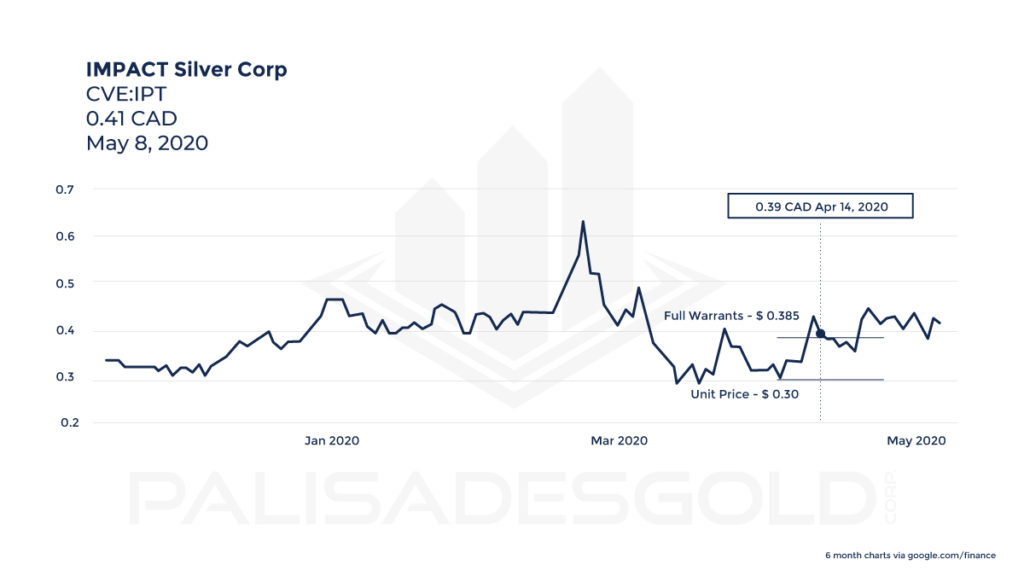

Impact Silver (TSX-V:IPT) is a small scale silver producer with a reasonable track record. Due to current silver prices and a temporary mine closure related to COVID, management thought that bolstering their balance sheet was a prudent move.

In that vein, Palisades provided the company $2.0M at $0.30 per share, with the inclusion of a three-year warrant at $0.385. Note, the unit price was done at a discount to market.

Now imagine that silver prices increase and Impact begins to generate solid profits in the months and years ahead. Let’s say for example that the stock reverts to its 5 year high of $1.20, which is not out of the question.

Our $0.30 shares would quadruple in value, turning a $2.0M investment into $8.0M. But on top of that, our full warrants give us the option to purchase additional shares at $0.385 at any time, and sell those shares the very same day at $1.20. Instead of pocketing a cool quadruple on $2.0M, for a $6.0M profit; with the inclusion of warrants, we would make an additional $5.4M! That is a total profit of $11.4M.

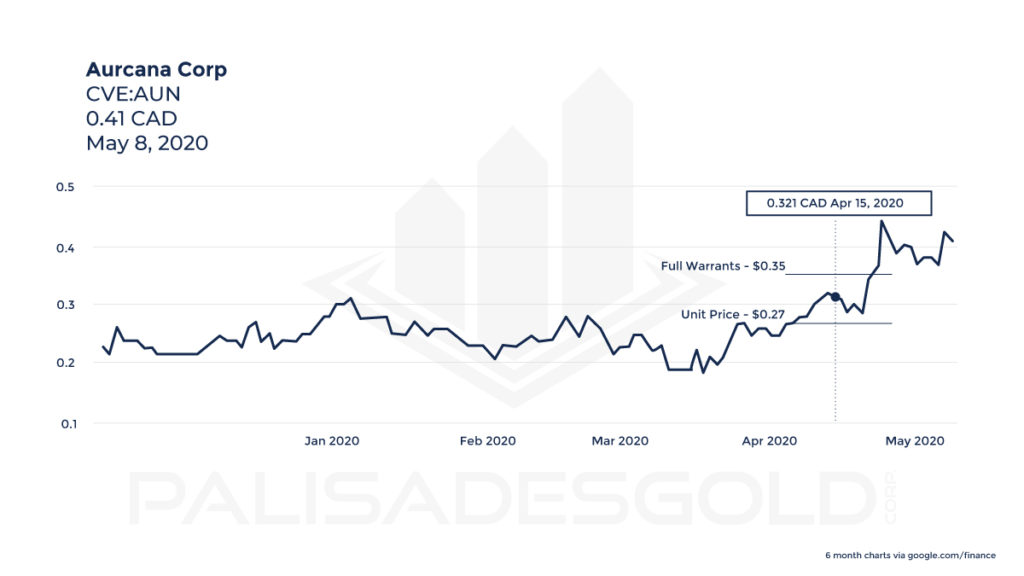

Aurcana Corporation (TSX-V:AUN) is another silver focused developer, nearing production at their Revenue-Virginius Mine in Colorado. The company is cashed up, run by industry professionals, and well positioned to benefit off any future rally in silver.

Palisades provided the company $2M at $0.27 per share, with a full three-year warrant attached at $0.35. Once again, the unit price was done at a discount to market.

If Aurcana rallies back to $1.00 per share, Palisades’ initial $2.0M investment would be worth $7.4M. The warrants, exercisable at $0.35 would be in the money by another $4.8M. Together, that equates to a profit of $10.2M.

Where the math gets really interesting is when one factors in velocity of capital. We might decide that in six or eight months that we’d like to sell part of our original investment and redeploy the capital. Whatever we decide to do with the shares though, the warrants remain in our portfolio.

Deploying capital into deeply discounted junior resource companies via private placements is an integral part of the strategy at Palisades Goldcorp and just another way that we are able to generate spectacular returns in what is going to be a bull market to remember.

Until next week,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.