Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

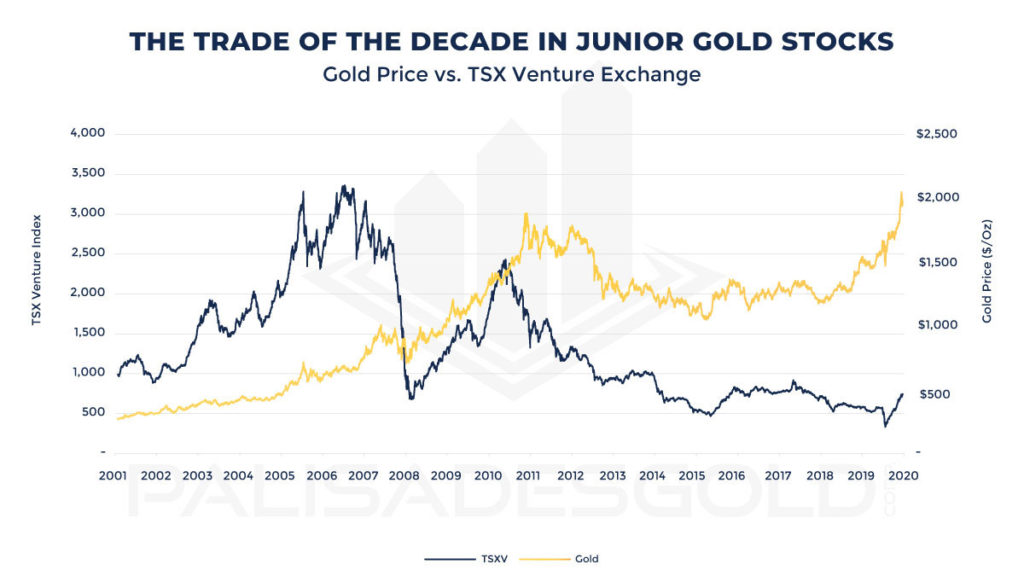

The Trade of the Decade in One Chart

Investors are uninformed when it comes to gold, but times are changing.

Gold’s ascension to all-time highs is beginning to capture the attention of the mainstream. With positive price targets from Bank of America and Goldman Sachs, and gold’s recent pop above $2,000, the public is starting to take note. Investors have piled into SPDR Gold Trust (NYSE:GLD) – so much so that ETFs that hold direct exposure to gold have seen a net increase of $40B since the beginning of 2019.

The same cannot be said for gold stocks, however. Over the same time period, ETFs that provide exposure to major gold miners have seen a net decrease in flow of funds. This is pretty staggering, but highlights just how under loved gold stocks are. Furthermore, it demonstrates that this bull market is in its early stages, with years left to play out.

Warren Buffett’s recent purchase of Barrick Gold has brought much needed awareness to gold miners. It could spark a wave of new buying from funds and retail investors alike, and buck the trend. This will positively impact the share prices of major miners, and continue to educate investors about the many ways to gain exposure to gold.

So far, we have looked at gold and gold miners, so what about the juniors?

If the concept of buying major gold miners like Barrick and Newmont is obscure to the average Joe, imagine how many investors are cognizant of a class of junior gold stocks that exist north of the border on an exchange called the TSX.

This lack of knowledge has driven a wedge in valuations – a wedge that continues to widen.

If you believe that the bull market in gold is real and here to stay, then there is no better place to capitalize than junior resource stocks. The disconnect between juniors and the underlying commodity is glaring…

While the TSX Venture Exchange, a well-known proxy for junior resource stocks, has seen a 100% move in the past five months, it is safe to say that the move has hardly begun.

What is about to unfold will be an epic game of catch up, further accelerated by gold continuing its move upward.

There is a tremendous amount of global capital yet to flow into the major mining companies. As this happens, and shares of gold miners appreciate, visibility will percolate to junior gold stocks. Slowly, word of this obscure class of companies called Canadian junior explorers will grab investor attention. The match will strike the matchbox, and a mania will ensue.

Until next week,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.