Collin Kettell

Palisades Goldcorp Ltd.

collin@palisades.ca

Palisades Goldcorp’s Second Go Public, in Nevada

New Found Gold IPO’d on August 11, 2020, and has by many accounts been one of the year’s most exciting IPOs. The stock is up over 200% since its debut as the company continues to explore the high-grade Keats Zone at its Queensway Project.

New Found initially started back in 2015, when Denis Laviolette and I ventured to Newfoundland in hopes of finding a district scale gold project. We quickly happened upon the Queensway (where I panned my first pan of gold) and the rest is history.

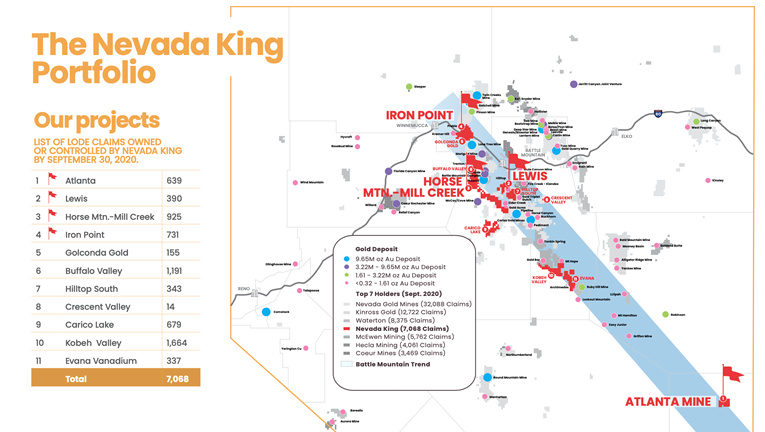

At that same time, we began another venture focused on becoming a leader in North America’s most prolific gold trend – the Battle Mountain Gold Trend. As the name suggests, Nevada King Mining focused its efforts in elephant country – Nevada, the world’s #1 mining jurisdiction.

When I was in my early teens, my Father wrote the founding check to start AuEx Ventures, a company that went on to discover the Long Canyon deposit. Long Canyon was ultimately sold to Newmont for $2.3B in 2011. This experience made an impression on me, namely, Nevada delivers outsized returns for gold discoveries.

With that knowledge, I set out to get my hands on as much of Nevada’s ground as possible.

In 2015, I met a geologist by the name of Cal Herron. We both had a similar concept in mind. You see, by 2015, the gold market was so bad that even Newmont and Barrick were struggling. Acquisitions they had made in prior years, including Long Canyon, hamstrung their finances. For the first time, the companies began shedding prime exploration targets within the prolific Battle Mountain Trend.

And so we began picking them up.

Fast forward to today and Nevada King is the fourth, and soon to be third largest landholder in the State of Nevada. We have acquired 98% of this ground through direct staking. That means we have no encumbrances – no NSRs, no work commitments, no option payments to third parties. Nevada King shareholders retain future upside.

It is with great excitement that we are now in the process of going public and we are doing it by way of a business combination with Victory Metals (TSX-V:VMX, OTC:VKMTF).

As soon as we complete the go public process, Nevada King will for the first time, begin aggressively drilling our gold targets. In fact, we plan to drill four projects in 2021, making Nevada King the most active explorer in the State.

We initially set out to raise a minimum of $8M. The demand has been quite strong and the book is now exceeding $10M and growing. The financing is being done at $0.55 per share. If you are interested, please email me at collin@palisades.ca. The books will close any day and we plan to close the financing on December 18th.

Alternatively, Victory Metals is currently trading. If making an investment in the financing is not a fit, you may look to purchase shares on the open market, (TSX-V:VMX, OTC:VKMTF).

Here is a link to the presentation for Nevada King, and here is short ten minute video by our Chief Operating Officer, Cal Herron, explaining the value drivers moving forward.

Until next time,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.